- home

- Invest

- Industries

- Beauty

Beauty/Fashion

Fashion Industry in Korea

Korea Fashion Market Size

Fashion market size by clothing type

| men’s suits | women’s suits | casual clothes | sport wear | under wear | children’s clothes | clothing market | Shoes | Bags | Fashion market | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2021 performance | 4.4536 trillion won | 3.850 trillion won | 17.4029 trillion won | 5.7896 trillion won | 2.668 trillion won | 1.1247 trillion won | 33.9227 trillion won | 6.6681 trillion won | 2.9385 trillion won | 43.529.2 trillion won |

General Status of Textile Fashion Industry(2020)

| Number of companies(units) | Employment(a thousand people) | |

|---|---|---|

| Manufacturing | 453,257 | 3,984,905 |

| Textile and Fashion Industry | 47,443 | 253,425 |

| Importance | 10.5% | 6.4% |

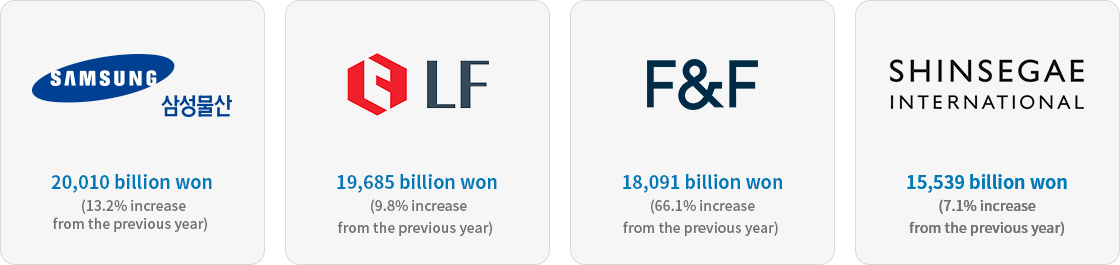

Top 4 Korean Fashion Companies (2022)

- Samsung C&T : 20,010 billion won(13.2% increase from the previous year)

- LF : 19,685 billion won(9.8% increase from the previous year)

- F&F : 18,091 billion won(66.1% increase from the previous year)

- Shinsegae International : 15,539 billion won(7.1% increase from the previous year)

Online Fashion Market Size

In 2022, the volume of online shopping mall transactions increased by 3.3% from the previous year.

Existing online shopping mall operators as well as offline operators are actively entering the E-commerce market and are experiencing rapid growth.

Zoom in

Zoom in

| Division | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|

| Turnover | 629,506 | - | - | 1,083,106 |

| YOY(*) | 312,351 | - | - | 511,278 |

A turnover trend of online fashion market

(Unit: one hundred million won)

| Division | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Turnover | 376,485 | 423,352 | 455,356 | 482,164 | 498,158 |

| YOY(*) | - | 12.4% | 7.6% | 5.9% | 3.3% |

Seoul Fashion Industry

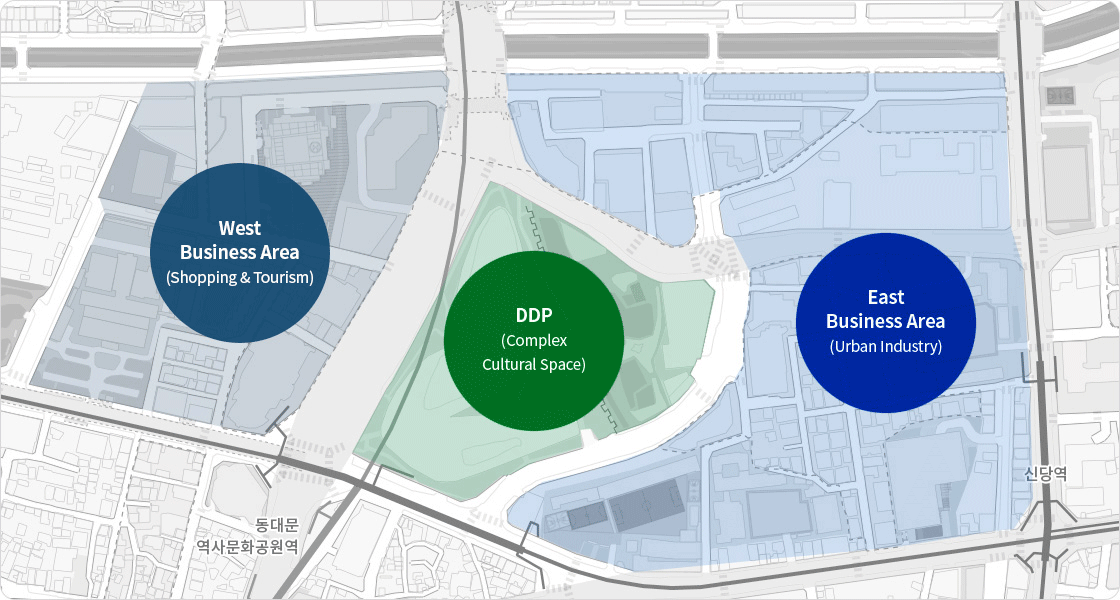

Dongdaemun Fashion Cluster

Dongdaemun, located in the center of Seoul, is a cluster of all fashion-related services from fashion-related stores to subsidiary materials and sewing factories for manufacturing.

Seoul Fashion Week

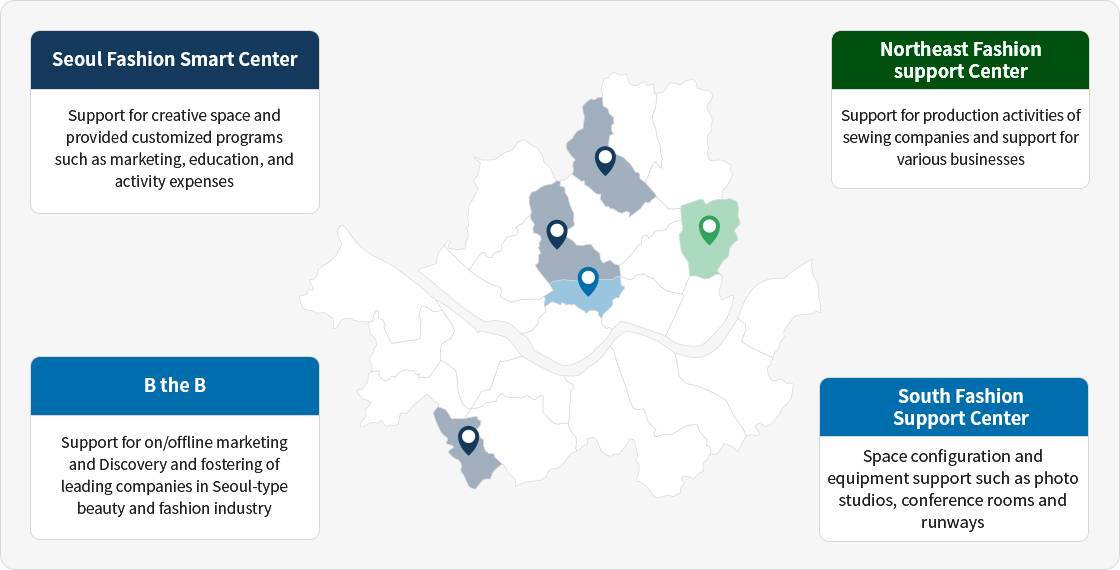

Support facilities for Fashion industry in Seoul

Zoom in

Zoom in

- Urban Fashion support Center (Seoul Fashion Creative Studio SFCS) - Support for creative space and provided customized programs such as marketing, education, and activity expenses

- Northeast Fashion support Center - Support for production activities of sewing companies and support for various businesses

- Southern Fashion Support Center - Space configuration and equipment support such as photo studios, conference rooms, and runways

- Northwest Fashion Support Center - Various business support such as fashion education, system establishment and space operation of the clothing manufacturing industry

Korea’s Cosmetic Industry

Korea’s Cosmetic Market Size

The cosmetic industry is a high value-added industry with a value-added per production unit that is about 10% higher than other industries.

The domestic cosmetic market has grown steadily to the extent that it ranks 10th in the world in terms of per capita consumption.

(Unit: one hundred million won)

| Division | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|

| Production | 13,515,507 | 15,502,800 | 16,263,316 | 15,161,717 | 16,653,313 |

| Exports | 5,589,815 | 1,420,038 | 1,458,314 | 1,378,367 | 1,493,988 |

| Market size | 9,255,399 | 10,032,996 | 10,113,008 | 7,604,934 | 7,635,695 |

Ranking of Sales of Domestic Cosmetic Companies

(Unit: one hundred million won)

| Ranking | Division | 2019 | 2020 | 2021 |

|---|---|---|---|---|

| 1 | LG H&H | 7,685,424 | 7,844,506 | 8,091,511 |

| 2 | Amorepacific Group | 6,284,255 | 4,930,083 | 5,326,080 |

| 3 | Amorepacific | 5,580,142 | 4,432,179 | 4,863,128 |

| 4 | BASF Korea | 1,634,347 | 1,905,257 | 2,713,964 |

| 5 | CJ Oliveyoung | 365,936 | 1,873,864 | 2,119,189 |

Seoul’s Strategy of Beauty Industry

The Seoul-type beauty industry aims to expand the concept of the beauty industry centered on cosmetics and beauty to the fashion and design industry, and to become a world-class beauty fashion city that includes culture, tourism, K-wave, and K-content.

Basic plan of ‘The Seoul, Global Beauty Hub’

11 core tasks in 4 sectors

-

Creating a cluster, the global beauty industry base

Establishing a core base for the Dongdaemun beauty and fashion industry

Vitalization of 6 major regional bases for beauty trends

Promote innovative technology R&D -

Creation of a virtuous cycle industrial ecosystem and high added value

Creation of beauty startups

Nurturing experts in the beauty industry -

Reinforcing marketing and expanding global expansion

Marketing support for promising SMEs

Acceleration of online and digital transformation of the beauty and fashion industries

Expansion of entry into the global market by beauty companies -

Maximize the attractiveness of Seoul, the city of beauty, through K-culture convergence

Holding the Seoul Beauty Week and Seoul Beauty Month

Establishment of a virtuous cycle of tourism and expansion of contents

Promoting the beauty city

Beauty Festival in Seoul

- Seoul International Cosmetics&Beauty Expo (CosmoBeauty Seoul) - Providing the customized B2B program and holding the professional seminars & conferences

- Seoul Beauty Week - a global beauty festival that exhibits the latest beauty trends and brands with potential, together with an opportunity to enjoy Seoul's cultural assets and K-wave