- home

- Invest

- Industries

- BT

Competitiveness of Bio Industry

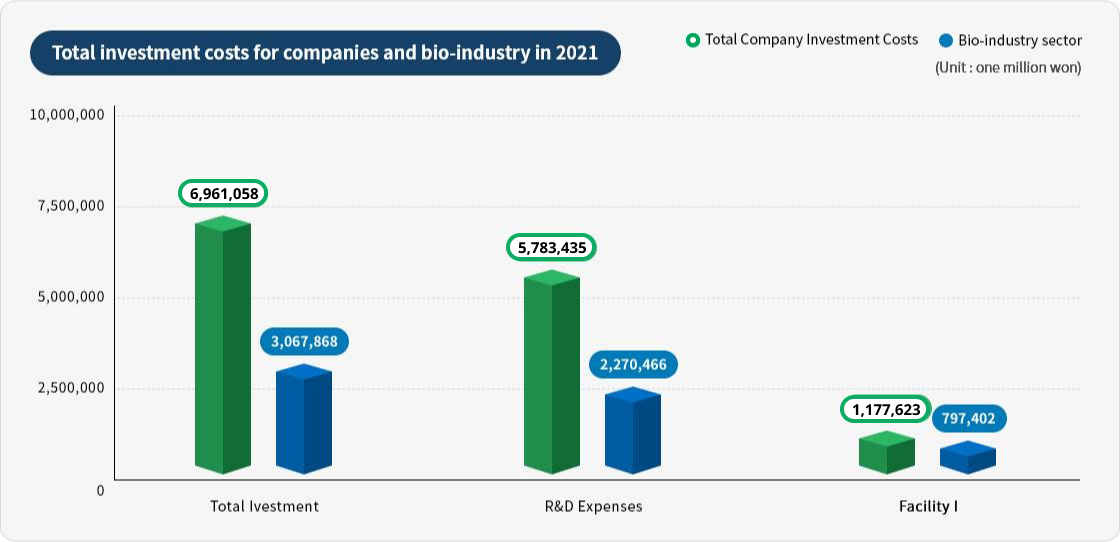

Investment status of the Bio Industry

The total investment cost of bio-industry companies in 2021 was KRW 6.961.1 billion. The total investment in the bio-industry sector was KRW 3.067.9 billion, accounting for 44.1% of the total investment.

- Total investment

- Total Company Investment Costs : 6,961,058 million won

- Bio-industry sector : 3,067,868 million won

- R&D Expenses

- Total Company Investment Costs : 5,783,435 million won

- Bio-industry sector : 2,270,466 million won

- Facility I

- Total Company Investment Costs : 1,177,623 million won

- Bio-industry sector : 797,402 million won

※ Source : Korea BIO, Report on Survey of Domestic Bio Industry 2021

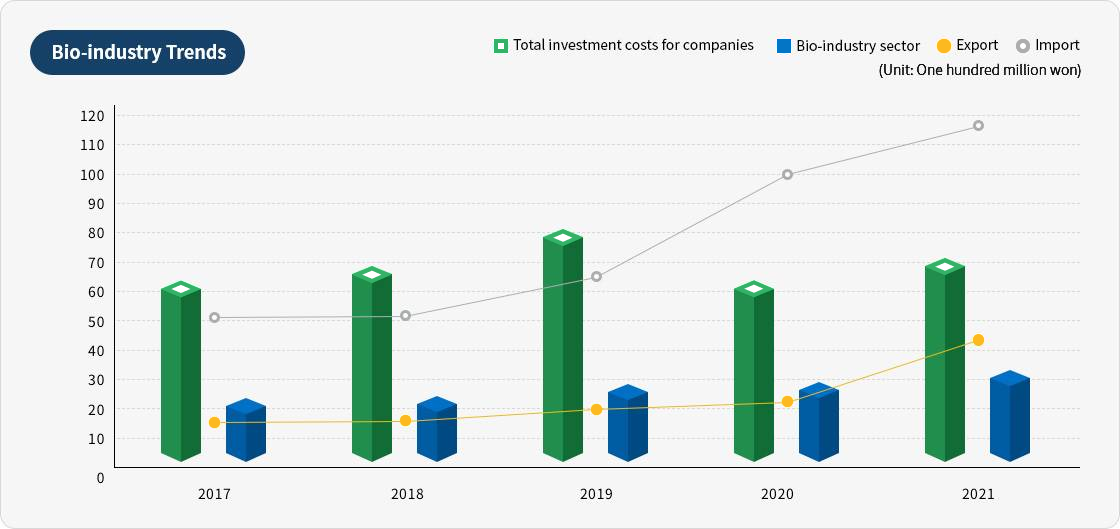

Bio-industry Growth

The total pharmaceutical production in 2021 was about US$19.4 billion (KRW 25.49 trillion), and the average annual growth rate of the pharmaceutical market for the last 5 years is shown at 3.3%.

- 2017

- Total investment costs for campanies: 60 hundreds milion won

- Bio-industry Sector: 20 hundreds milion won

- Export: 15 hundreds milion won

- Import: 50 hundreds milion won

- 2018

- Total investment costs for campanies: 68 hundreds milion won

- Bio-industry Sector: 22 hundreds milion won

- Export: 17 hundreds milion won

- Import: 51 hundreds milion won

- 2019

- Total investment costs for campanies: 80 hundreds milion won

- Bio-industry Sector: 28 hundreds milion won

- Export: 20 hundreds milion won

- Import: 65 hundreds milion won

- 2020

- Total investment costs for campanies: 62 hundreds milion won

- Bio-industry Sector: 29 hundreds milion won

- Export: 22 hundreds milion won

- Import: 100 hundreds milion won

- 2021

- Total investment costs for campanies: 70 hundreds milion won

- Bio-industry Sector: 42hundreds milion won

- Export: 43 hundreds milion won

- Import: 128 hundreds milion won

※ Source : Korea BIO, Report on Survey of Domestic Bio Industry 2017-2021

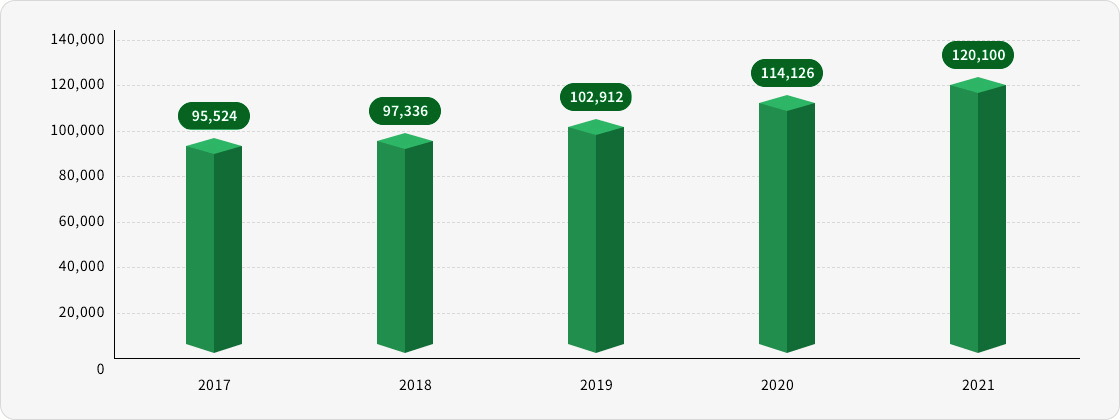

Average Annual Bio-industry Workforce

Over the past five years, the amount of manpower in the Bio-Industry has been steadily increasing by 4.86%.

Changes in manpower in the Bio industry from 2017 to 2021

(Unit : Number of people, %)

| Manpower | 2017 | 2018 | 2019 | 2020 | 2021 | CAGR(*) |

|---|---|---|---|---|---|---|

| Number of employees | 95,524 | 97,336 | 102,912 | 114,126 | 120,100 | 4,86 |

| Percentage change | 0.6 | 1.9 | 5.7 | 10.9 | 5.2 |

(*)CAGR : Compound Annual Growth Rate

※ Source : KoreaBIO, Report on Survey of Domestic Bio Industry 2021

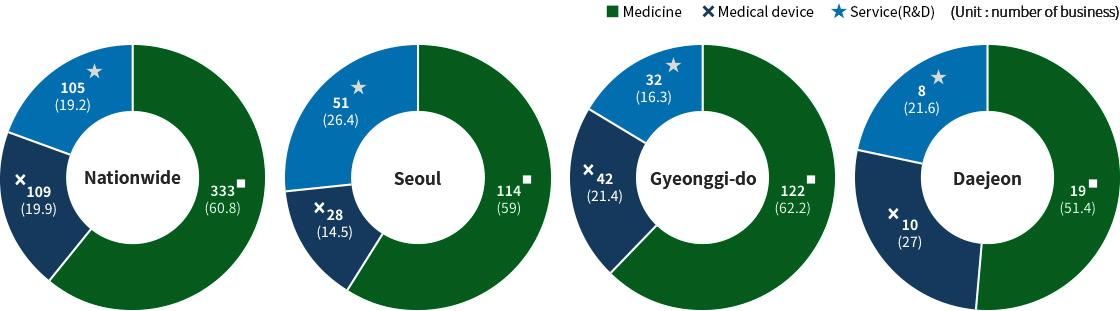

Number of Bio-industry Companies in Korea(2021): Total 1,055

Investment size by province in the Bio-industry 2021

(Unit: Number, one million won)

| Region | Number of companies | Number of responding companies | R&D expenses | Facility investment cost | Total investment cost | |||

|---|---|---|---|---|---|---|---|---|

| Total investment | Average investment | Total investment | Average investment | Total investment | Average investment | |||

| Nationwide | 1,055 | 966 | 2,270,466 | 2,219 | 797,402 | 779 | 3,067,868 | 2,999 |

| Seoul | 249 | 229 | 349,958 | 1,528 | 30,831 | 135 | 308,789 | 1,663 |

※ Source : KoreaBIO, Report on Survey of Domestic Bioindustry 2021

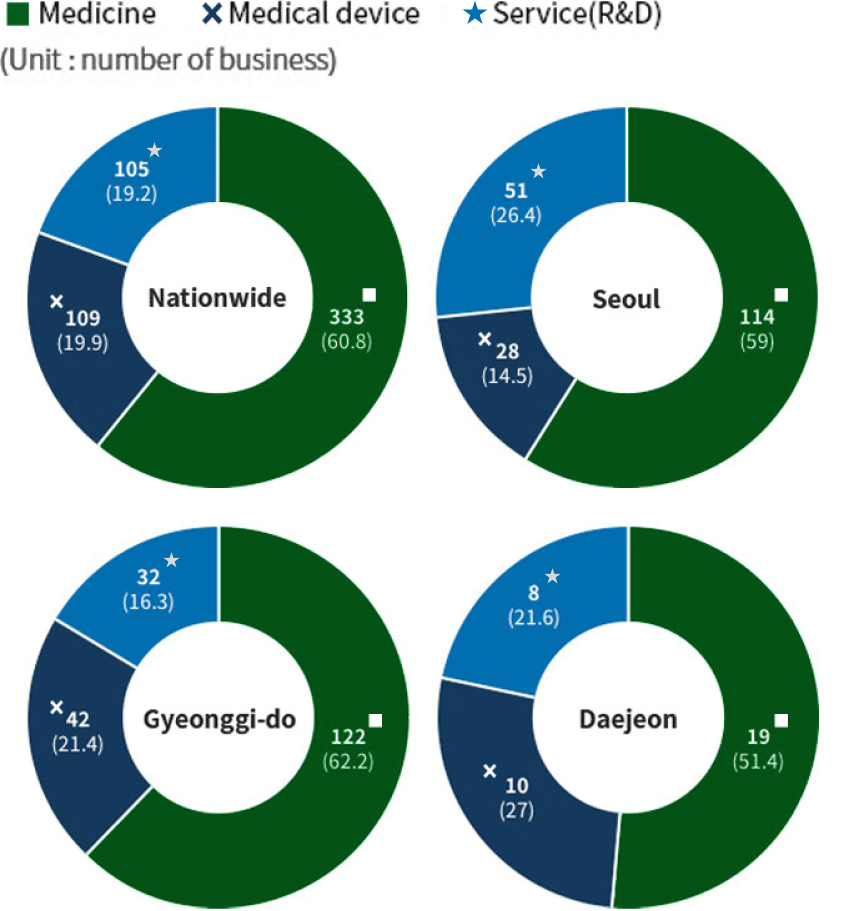

Bio-industry Ecosystem in Seoul

Seoul Biomedical Business

35.3% of national biomedical businesses are located in Seoul. As Bio service occupies a relatively large proportion, Seoul is positioned as a center of R&D.

- Nationwide

- Medicine: 333 (60.8%)

- Medical device: 109 (19.9%)

- Service(R&D): 105 (19.2%)

- Seoul

- Medicine: 114 (59%)

- Medical device: 109 (14.5%)

- Service(R&D): 105 (26.4%)

- Gyeonggi-do

- Medicine: 122 (62.2%)

- Medical device: 42 (21.4%)

- Service(R&D): 32 (16.3%)

- Daejeon

- Medicine: 19 (51.4%)

- Medical device: 10 (27%)

- Service(R&D): 8 (21.6%)

※ Source : KoreaBIO, Report on Survey of Domestic Bioindustry 2021

General status of the Bio-industry

Status of Bio-industry by field & region (2021)

(Unit: number, %)

| Region | Medicine | Medical device | Service | Total | ||||

|---|---|---|---|---|---|---|---|---|

| number | rate | number | rate | number | rate | number | rate | |

| Nationwide | 333 | 100.0 | 109 | 100.0 | 105 | 100.0 | 547 | 100.0 |

| Seoul | 114 | 34.2 | 28 | 25.7 | 51 | 48.6 | 193 | 35.3 |

| Gyeonggi-do | 122 | 36.6 | 42 | 38.5 | 32 | 30.5 | 196 | 35.8 |

| Daejeon | 19 | 5.7 | 10 | 9.2 | 8 | 7.6 | 37 | 6.8 |

| Others | 78 | 23.4 | 29 | 26.6 | 14 | 13.3 | 121 | 22.1 |

※ Source : Korea BIO, Report on Survey of Domestic Bio Industry 2021

Bio-industry Investment by Region

Investment size by region in the bio-industry 2021

(Unit: number, one million won)

| Region | Number of companies | Number of responding companies | R&D expenses | Facility investment cost | Total investment | |||

|---|---|---|---|---|---|---|---|---|

| Total investment |

Average investment |

Total investment |

Average investment |

Total investment |

Average investment |

|||

| Total | 1,055 | 1,023 | 2,270,466 | 2,219 | 790,402 | 779 | 3,067,868 | 2,999 |

| Seoul | 249 | 229 | 349,958 | 1,528 | 30,831 | 135 | 308,789 | 1,663 |

| Gyeonggi | 350 | 346 | 876,356 | 2,533 | 243,619 | 704 | 1,119,975 | 3,237 |

| Daejeon | 84 | 84 | 164,780 | 1,962 | 44,175 | 526 | 208,955 | 2,488 |

| Chungbuk | 84 | 84 | 317,991 | 3,878 | 66,587 | 812 | 384,578 | 4,690 |

| Others | 288 | 282 | 561,381 | 1,991 | 412,190 | 1,462 | 973,351 | 3,452 |

※ Source : KoreaBIO, Report on Survey of Domestic Bio-industry 2021

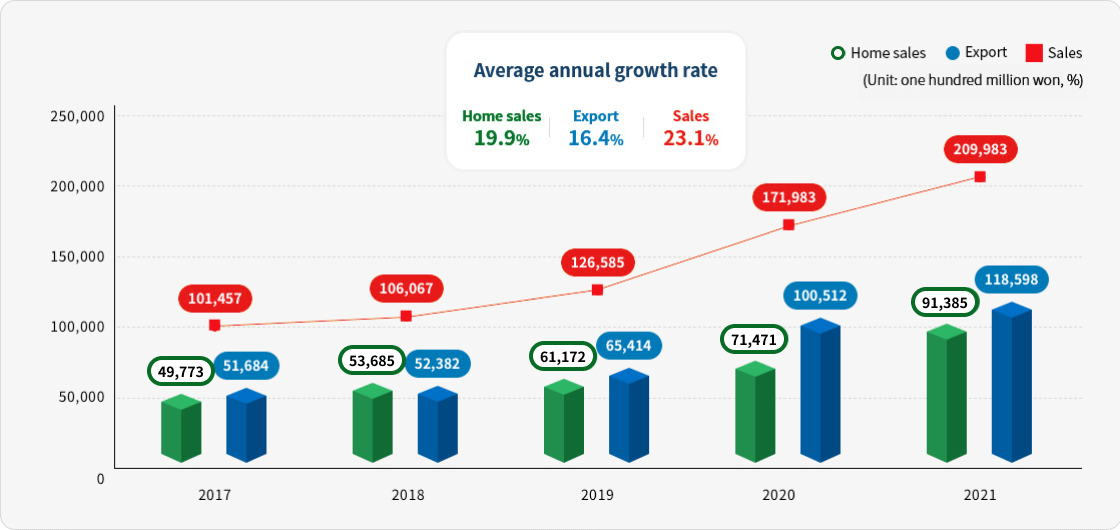

Domestic Biomedical industry Sales Scale

- Home sales: 19.9%

- Export: 16.4%

- Sales: 23.1%

- 2017

- home sales: 49,773 hundred million won

- export: 51,684 hundred million won

- sales: 101,457 hundred million won

- 2018

- home sales: 53,685 hundred million won

- export: 52,382 hundred million won

- sales: 106,067 hundred million won

- 2019

- home sales: 61,172 hundred million won

- export: 65,414 hundred million won

- sales: 126,585 hundred million won

- 2020

- home sales: 71,471 hundred million won

- export: 100,512 hundred million won

- sales: 171,983 hundred million won

- 2021

- home sales: 91,385 hundred million won

- export: 118,598 hundred million won

- sales: 209,983 hundred million won

※ Sales = Home sales + Export

※ Source : KoreaBIO, 2017-2021 Bio-industry Trend Analysis and In-depth Study(7)

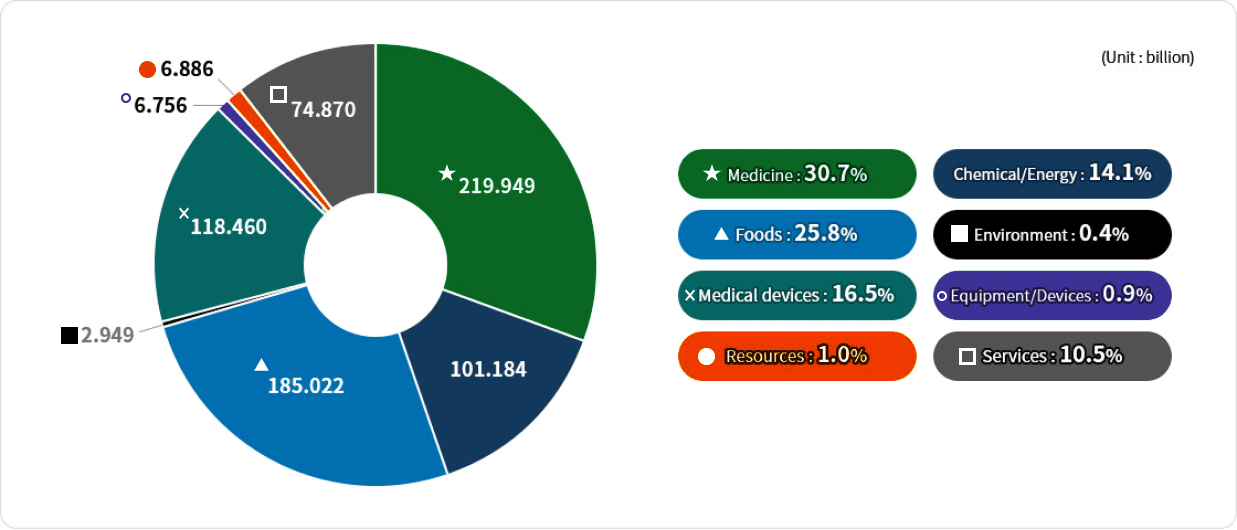

Cumulative sales composition ratio of Bio-industry by sector (accumulated from 2017 to 2021)

- Medicine: 219.949 billion (30.7%)

- Foods: 185.022 billion (25.8%)

- Medical devices: 118.460 billion (16.5%)

- Chemical/Energy: 101.184 billion (14.1%)

- Services: 74.870 billion (10.5%)

- Resources: 6.886 billion (1.0%)

- Equipment/Devices: 6.756 billion (0.9%)

- Environment/Devices: 2.949 billion (0.4%)

※ Source : KoreaBIO, 2017-2021 Bio-health Industry Trend Analysis and In-depth Study(7)

Current status of global clinical trials

Worldwide Clinical Trials Ranking

-

Clinical trials share by

Korea ranked 5th (1 step up from 2021)

country(2022) -

Global ranking of clinical

Seoul ranked 1st for 3 consecutive years

trials by city worldwide -

Ranking of clinical trials by a single country

Korea ranked 3rd for 4 consecutive years

※ Source : www.clinicaltrials.gov